Guaranteed funds: the swan song

La compagnie d’assurance Generali Vie a annoncé fin septembre sa décision de ralentir fortement la collecte sur les fonds garantis en euros et de favoriser clairement la souscription par ses clients…

At the end of September, the insurance company Generali Vie announced its decision to slow down significantly the collection of funds guaranteed in euros and to clearly favour the subscription by its customers of units of account, i.e. Sicavs and mutual funds (FCP) in concrete terms. This decision was immediately followed by other insurers in Paris, such as Allianz, who also announced their unambiguous intention to increase unit-linked subscriptions at the expense of the euro-denominated assets that savers value for their capital guarantee.

Negative interest rates torpedo life insurance: Allianz France believes that euro funds with capital guarantees are a "relic of a bygone era"(Les Echos)https://t.co/bs0aM9ZeT9

— Philippe Herlin (@philippeherlin) september 26th 2019

It should be remembered that euro-denominated assets are guaranteed by the insurance companies that bear the risk, whereas unit-linked products place the risk on the end customer. Unit-linked products can be diversified, and some life insurance policies offer several hundred different products.

Low rates and attractive performance

There are two reasons for this decision.

On the one hand, we are in a situation of extremely low, or even negative, interest rates, which means that the profitability of guaranteed assets, mainly bonds, is increasingly low. For some companies, the good profitability achieved in recent years is due to the distribution of reserves accumulated during more buoyant periods.

The sensitive point is that the higher the inflows into euro funds, the more they will be invested in new low-rate securities, leading to a decline in overall profitability and making it difficult to maintain attractive rates for customers. Many insurers are now subconsciously hoping for a wave of redemptions of euro-denominated assets, which have become a costly drag on the Paris financial centre.

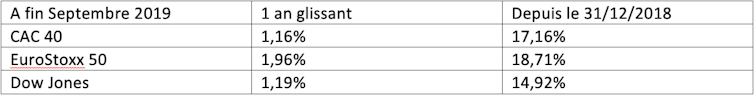

On the other hand, it has to be said that the long-term financial markets, and equity markets in general, have been on a positive trend since the start of the year, and this has led to attractive returns.

On the other hand, these same financial markets, even if they generally follow a positive long-term trend, can, just like the economy which is growing or shrinking, suffer setbacks, sometimes painful.

We are therefore going to see a major paradigm shift for French savers. Gone are the safe-haven funds, and in come the higher-yielding but more volatile ones.

Education needs to be reviewed

In this context, two precautions need to be taken.

The first step is to take into account the psychological aspects of investing. Individuals generally have a strong aversion to loss, which can lead to sub-optimal buying and selling behaviour. By way of illustration, the disposition effect, which leads individuals to sell winning assets and hold on to losing ones, can lead to situations where the performance of a portfolio is persistently below that of its reference market. The disposition effect is often explained as a manifestation of loss aversion. Other sub-optimal behaviours can also be identified, such as home bias, the consequence of which is poor portfolio diversification due to concentration on domestic securities.

Secondly, all stakeholders (the financial industry, intermediaries, political leaders) will need to become involved in developing financial education. Assuming that the majority of retail investors subscribe to unit-linked products, which often offer higher returns than euro-denominated assets, they will soon be faced with questions relating to the basic concepts of the financial markets, such as :

- What is the difference between equities and bonds?

- What are the advantages of a diversified portfolio?

- How do you measure the profitability and risk of a financial instrument?

- What is compound interest?

- What impact does inflation have on profitability?

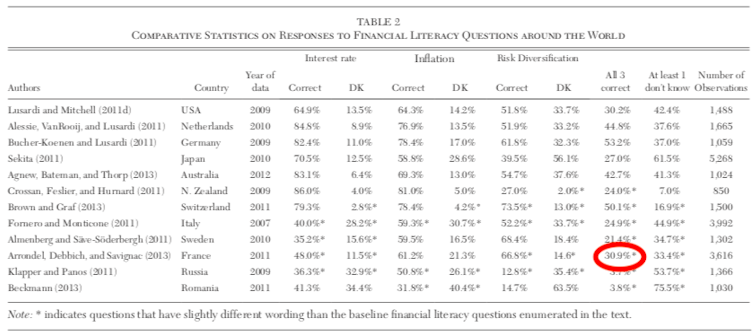

The answers to all these questions are elementary for professionals, but far from obvious for individual customers. Academic research into financial literacy shows that France lags behind other countries in the world. On fundamental questions such as those mentioned above, the score for the various countries (percentage of the total number of correct answers) is 30.9% in France, compared with 53.2% in Germany and 44.8% in the Netherlands. These figures show the extent of France's deficit in this area and the task ahead.

Does this mean that euro funds are finished for good? The answer is no. The role of the euro fund should be that traditionally assigned to the risk-free asset in financial theory, i.e. a vehicle for satisfying strong risk aversion. The risk-free asset offers a low return and a capital guarantee, but it is no longer intended to receive 80% of savers' contributions.

The transformation of guaranteed savings into non-guaranteed savings is positive for the financing of the economy and is well within the grasp of political leaders. On the other hand, they must accept that investors need to be brought up to speed if they are to avoid the kind of disappointments they experienced in 2001 during the tech stock bubble.

This article is co-published with The Conversation France under Creative Commons license. Read the original article.